For many homeowners, insurance is a safety net—but not all safety nets catch the same things. In Destin, where hurricanes and flash floods are a very real threat, it’s easy to assume your standard policy covers you against water damage. The reality? It often doesn’t, and that gap can leave families facing major out-of-pocket expenses after a storm.

Confused about whether your homeowners policy protects against flood damage? True North Restoration is here to help with this simple, easy-to-follow FAQ guide.

Does my homeowners insurance cover flooding?

Most of the time, no .

A standard homeowners policy typically covers water damage that comes from inside your home , like:

- Burst or leaking pipes

- Roof leaks caused by storms

- Water damage from appliances (dishwashers, washing machines, etc.)

But it does not cover water that comes from outside , such as:

- Flooding from storm surge or hurricanes

- Heavy rainfall that pools or flows into your home

- Rising rivers, lakes, or tidal flooding

For Destin homeowners in low-lying or coastal areas, a flood insurance policy is the best way to protect your home and belongings.

So, what does flood insurance cover?

Flood insurance is a separate policy , usually purchased through the National Flood Insurance Program (NFIP) or private insurers.

It’s designed to cover what homeowners insurance won’t, including:

- Structural damage (foundation, walls, major systems)

- Electrical and plumbing systems

- Built-in appliances (like refrigerators and water heaters)

- Flooring, cabinets, and carpeting

- Personal belongings (with added contents coverage)

If your home is hit by flooding , a flood policy can be the difference between rebuilding and going broke.

Why is flood insurance so important in Destin?

Destin’s location on the Gulf of Mexico makes it especially vulnerable to flooding.

Factors that increase the risk include:

- Hurricane storm surges – Powerful storms can push seawater inland, flooding streets and homes.

- Heavy tropical rainfall – Even without a hurricane, intense rain can overwhelm drainage systems and cause water to enter properties.

- High groundwater levels – Coastal areas often have saturated soil, which can lead to basement or foundation flooding during storms.

Even homes outside of officially designated high-risk flood zones are not immune. In fact, FEMA says over 20% of flood claims come from low- or moderate-risk areas , making flood insurance essential for most Destin homeowners.

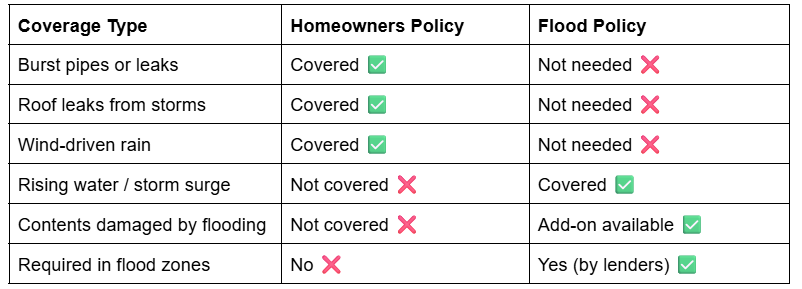

What is the main difference between homeowners insurance and flood insurance?

Here’s a quick side-by-side comparison:

How can I make sure I’m fully protected?

Being prepared is the key to avoiding costly surprises from water damage.

Follow these steps to safeguard your home:

- Review your policy – Know exactly what your homeowners insurance includes and excludes.

- Check FEMA flood maps – Don’t assume you’re safe just because you’re not in a “high-risk” zone.

- Consider a flood policy – Premiums are often far less than the cost of repairing flood damage.

- Have a restoration partner ready – Companies like True North Restoration can handle cleanup, insurance coordination, and full restoration when disaster strikes.

By taking these proactive steps, you can protect your home, your belongings, and your peace of mind when storms hit the Gulf Coast.

What’s the bottom line?

- Homeowners insurance protects against common household risks (fires, leaks, storm damage).

- Flood insurance protects against flooding (storm surge, heavy rainfall, rising water).

- Together, they provide full protection —and for Destin homeowners, that’s essential.

True North Restoration: Destin’s Trusted Flood & Water Damage Experts

When water damage strikes, every minute counts. At True North Restoration , we combine speed, expertise, and local knowledge to help homeowners across Destin and the surrounding Gulf Coast recover quickly and confidently.

Here’s why families trust us:

- Rapid 24/7 Emergency Response – We’re on-site in an average of 45 minutes, minimizing damage and getting your home back to normal fast.

- Free Consultations – Our team provides clear guidance and answers your questions upfront, so you know exactly what to expect.

- Insurance Support – We work directly with your insurance company, documenting damage and simplifying the claims process.

- Certified Restoration Experts – Our team is fully trained in water, fire, and mold remediation, using the latest techniques and technology to restore your home completely.

When the unexpected happens, True North Restoration is ready to step in . From water extraction and mold remediation to full structural restoration, we handle every step so you don’t have to.